Alun Beynon, Head of Intermediary Protection Distribution, Scottish Widows

The Swiss Life Term and Health watch 2022 reported that over 50% of our Level Term Assurance sales through the intermediated channel in 2021 were made through unadvised distribution channels. For those of us who have been tracking market trends for many years, this does not come as a surprise.

Ever since the retail distribution review, which came into effect in 2012, but was actually first tabled in 2006, we have seen a year on year decline in the number of protection sales through the UKs community of holistic financial planners. They now account for just 16% of intermediated protection sales.

The mortgage broking community doesn't really pick up the slack either - accounting for 29% of sales. Mortgage brokers, adopt what might be described as a "laissez-faire" attitude to the provision of protection. This is hard to fathom. Facilitating the biggest debt a consumer is ever likely to have and not supporting this with protection advice seems counter intuitive.

It is clear that the majority of financial planners and mortgage brokers don't have a great engagement with the protection market.

The purpose of this article is not to explore why they don't have a better engagement, but to outline why it matters.

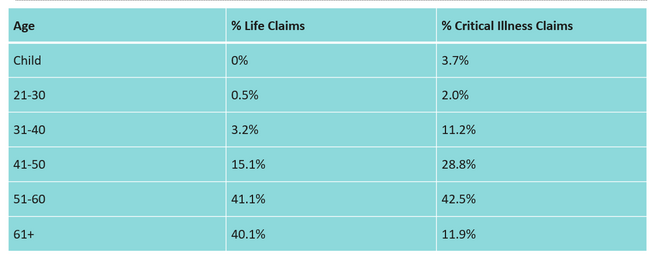

In 2021, Scottish Widows paid 10,426 claims totalling £207.9 million but if we break this down into age bands, a story emerges.

This is a stark illustration of the fact that unforeseen events occur within all age demographics and an adviser should at very least be making the client aware of these.

While we know mortality rates are improving, 18.3% of death claims occur between the ages of 31-50, which is a significant minority, morbidity rates do not appear to be improving with 40% of CI claims occurring between the age of 31-50

Earlier this year, Halifax advised that the average UK first-time buyer is now older than 30. This moves many of those taking their first steps on the property ladder into a much higher likelihood for claim, particularly critical illness.

Happily, survival rates are improving, but we should not let that mask the financial and emotional impacts of a critical illness diagnosis.

For holistic financial planners, who are busy accumulating funds under management for their retirement customers, it might be worth reflecting on how they might serve the protection needs of their customers children for it will be they who inherit the accumulated funds once the their core customer drops off the conveyor belt of life.

Equally, Mortgage brokers should reflect on how they are serving the best interest of their customers by swerving a conversation about financial vulnerability in the event of unforeseen circumstances.

With Consumer Duty legislation on the horizon, all distributors and insurers will be forced to confront whether they are serving the best interests of customers.

This post is funded by Scottish Widows

Sources: Scottish Widows Claims statistics, 2021