Alun Beynon, Head of Intermediary Protection Distribution at Scottish Widows

The Swiss Re Term and Health Watch 2021 reported total new protection sales of nearly 1.3m, a figure which excludes the 300k guaranteed acceptance whole of life (funeral) plans.

Of this 1.3m sales, just 12,000 related to business protection.

Don't fall into the trap of thinking that that figure is an aberration attributed to the pandemic. If you average annual business protection sales between 2016-19, then you are looking at a figure that amounts to a not very impressive 20,000 sales per year.

In other words, Business Protection policies account for less than 1% of protection sales.

If we layered Relevant Life Protection sales onto Business Protection then we would add a further 18,000 sales, so collectively Business Protection and Relevant Life sales account for 2.3% of all protection sales.

Is this performance a reflection of the market opportunity?

How can the Market Opportunity be assessed?

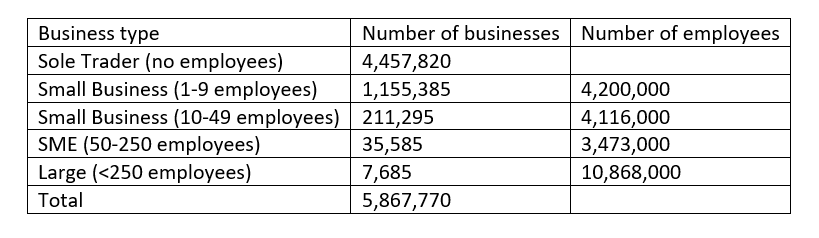

To start to address this question, we have looked at data reported by The Department for Business, Energy and Industrial Strategy (BEIS) - which shows that in 2019 there were nearly 5.9m private sector businesses in the UK, and these were broken down as follows:

Of the 5.9m businesses 99.9% of them fall into the small or medium size enterprise category.

The success or failure of each of these businesses will invariably depend on a very small core of key individuals which will be reflected in either the turnover of the business or indeed the borrowing of the business.

Key person cover (and we would argue that corporate lending can be a subset of Key person cover) probably represents the simplest segment of the business protection market.

- Over 10m employees are employed by 1.4m small / medium businesses.

- Key person / Corporate loan protection does not just underpin the financial resilience of the business but also the families of the people they employ

- Commercial mortgages, small business loans, bridging loans, start-up loans, bounce back loans (recovery loan schemes) - are some examples of corporate lending made available to small business. So, understanding how highly geared a business is will give an insight into its potential vulnerability to the loss or incapacity of key people.

Other covers beyond keyperson cover and corporate loan protection, include shareholder protection and partnership protection. These extend the scope of business protection but generally require a step up in technical complexity, not least because you are invariably considering the interaction between multiple lives insured in the event of death or incapacity of one or more of the lives.

So, with this very basic analysis, it is not difficult to outline the business protection opportunity. This is no secret. Insurance companies, armed with iterations of this type of analysis have over many decades expended resource, time and energy into trying to incite a business protection revolution, but it has never succeeded.

The opportunity exists, but it has been a latent opportunity and the conundrum is that it continues to be latent - so why is this?

What are the barriers to engagement with business protection?

There are several perspectives to consider:

- The UK has a very disparate protection distribution landscape and accessing the business protection opportunity is not as straight forward as it sounds.

- Corporate entities generally all have a retail business bank and an accountant. This means they are likely to develop trusted and embedded relationships with advisers in financial markets that have little or no focus on insurance needs.

- Not all Corporate entities will have access to a Corporate financial planning adviser or indeed a Private client adviser, but those that do generally do so to receive advice on pension provision for themselves and their employees.

- Neither Banks, Accountants or financial advisers have a focus on protection advice and so it falls through gaps - with no one taking ownership.

- Insurer's have periodic campaigns that invariably treat the symptom rather than the cause. They create excellent entry level marketing collateral along with more detailed technical collateral aimed at building understanding and offering CPD - but this doesn't shift the production dial in a sustainable way and the net result is a very poor return on investment.

- Couple this last point with the perception that the business protection tends to be more manually intensive with a clunkier journey - then advisers are not committing to exploiting the opportunity.

- In essence, there is a lack of focus on the protection market in key channels which is a cultural challenge.

So how can the business protection conundrum be resolved?

There is no silver bullet.

Banks and accountants are unlikely to spearhead any committed approach to the provision of business protection.

The distribution channel with greatest potential to address the opportunity in term of access and referral point are the financial planning community of advisers.

Each firm of financial advisers will have their own modus operandi and the overwhelming majority adopt a reactive approach to the provision of protection advice generally, let alone business protection. This in itself creates a range of inefficiencies both for the adviser and the insurer which does not encourage wider engagement..

So to really shift the dial on business protection ( and individual protection) sales, financial advice firms need to adopt a proactive approach to the development of their protection book. There are many ways that this could be achieved which would need to be underpinned by:

- Recognition of the opportunity, the value to the customer, the value to your business and a commitment to building a protection proposition.

- Creation of an engagement framework:

- What goals and priorities?

- Determine actions to achieve your goals

- Deploy resource to execute the actions

There are many approaches that can be undertaken to achieve these outcomes and insurance companies would fall over themselves in a rush to support and provide guidance to firms wanting to develop their protection book.

If we continue to do what we have always done and default to the provision of CPD accredited technical and sales training modules then we will not make progress.