Most working parents will consider it a successful day if they can get the children up nice and early before nursery or school starts, and ensure they're fully washed, dressed, fed, and dropped off.

If that happens without fuss and still on time to make their own job and working commitments on schedule, then they have truly won!

That's a typical day, but reality can sometimes look quite different.

When we least expect it, an accident or illness can put the brakes on that everyday routine. Things really can change in the blink of an eye, and the short-term implications of that are significant.

Even a minor accident can send a child to hospital, and that usually requires time off work and expenses like car parking or public transport, that many find difficult to manage.

Worryingly, MetLife's latest research found that over half (52%) of parents have no form of financial protection policy in place if that happens.

And it's even higher among the self-employed - at 56%.

Who are the groups most at risk from a lack of a financial safety net?

According to the latest UK labour market statistics there are 2.4 million self-employed people in this country.

This suggests a significant proportion of that 2.4 million could be lacking protection in place to prevent against the potential for payment or salary/income gaps.

But there are other high-risk groups too. Our research showed that those at risk include:

- Almost two in three (65%) of those that work part-time

- Nearly two in five (39%) who are employed on zero-hour contracts

All of these groups are at a high-risk financially if they have to take time off from work to care for their children if they have an accident or are injured.

What this highlights is that it is often those that would benefit most that lack the safety net of financial protection.

An accident or illness in a child is a stressful time, no one needs financial pressure to be added to that emotional pressure. The knock-on effect can reverberate through the rest of the family.

So why are those most at risk so unprepared?

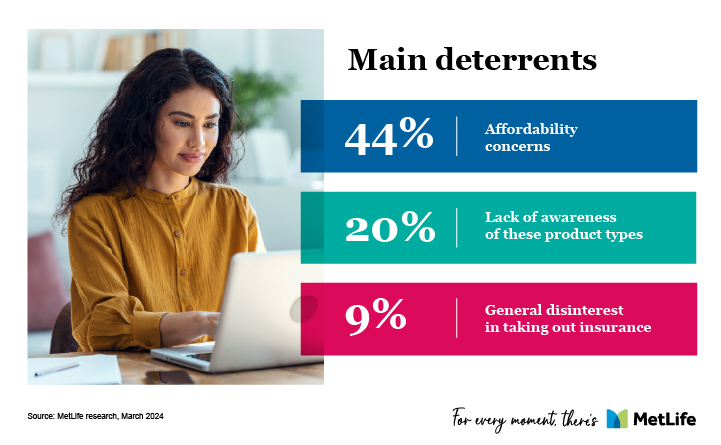

Our research found that the main deterrents that prevented people taking out financial protection products included affordability concerns (44%), a lack of awareness of these type of products (20%), and general disinterest in taking out insurance policies (9%).

The awareness point is fascinating and shows how much more we as an industry can do to help people understand the products available.

That said, there are some promising signs. 48% of working parents revealed they do have some form of protection in place, so the industry is reaching nearly half of those that could benefit.

The onus is on the protection industry to cater for those needs.

How do we bridge the gap and provide a real solution that protects the unprepared?

Families are under increasing financial pressure, having to stretch budgets to meet daily costs leaving most with little or no savings to rely on. That is why it is crucial we as an industry work in tandem with the new government and employers to provide the right levels of financial support quickly.

We need to be providing products that are affordable, offer a good level of protection for life's ups and downs, help to reduce emotional and financial stress, and ensure all are widely available and accessible to families.

That's why, in a bid to further help reduce any feelings of stress or concern among working parents, MetLife launched ChildShield, providing parents with financial protection from as little as £6 per month.

This is one helpful solution for working parents and helps to remove some of the stress and worry they face when their child breaks a bone, is hospitalised or suffers a serious condition.

Combining that policy with unlimited access to our virtual GP services, as well as in-the-moment support from counsellors and nurses, is a win-win for parents, who get access to both financial protection and easy-to-use supportive services.

There is an undeniable link between our finances and our health – be it our own or our families and loved ones.

We know those who seek financial advice and planning often spend a long time finding the right fit for them.

This relationship – built on trust – is the same between our customers, clients, and their advisor when it comes to protection and health planning.

No matter what product innovation comes, there will always be a crucial role for advisors when it comes to communicating in real terms what the benefits are.

Rich Horner is Head of Individual Protection at MetLife UK